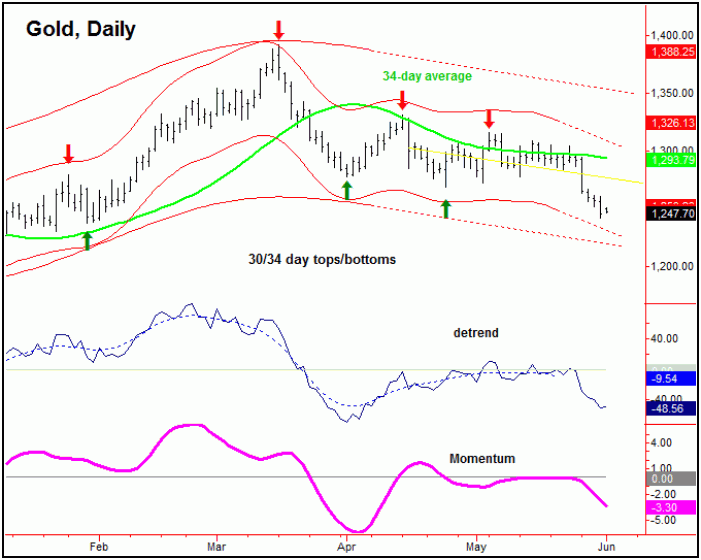

Market Outlook - June 2, 2014 - Publisher, Jim Curry

Since the prior report from Thursday, Gold has seen additional correction, here dropping

all the way down to a Friday low of 1242.20 – before bouncing slightly off the same

to end the week. As noted in the prior outlook, we are due for at least a short-term

rally with the 10 and 34-day cycles, if not something bigger – such as from the larger

72-day component.

With the above said and noted, any reversal back above the 1262.50 figure on Gold

– if seen at any point in the coming days – would confirm an upturn in the 10-day

cycle, and likely that of the larger 34-day wave as well. In terms of price, that

would mean a minimum rally back to the 10-day moving average (prior page) but, most

likely, would see a move on up to the higher 34-day moving average – with the latter

currently at the 1293 figure (chart, above).

From the 5/19/14 report: “taking out the 1289.00 figure favors the downward phase

of the 10-day cycle to be back in force. If correct then, as noted above the odds

will favor additional weakness in the coming days, with the metal ideally making

a test of the 1277.00 figure in the process. Stepping back, the same 1277.00 figure

on Gold looks to be the current dividing line between up and down phase of the larger

34-day wave (chart, above). With that, should this figure be taken out in the coming

days, then we would know that the next correction phase of this component is also

back in force. If that were to be triggered, then the recent 34-day upward phase

would have had to have formed the pattern of a ‘lower-high’, of which the low-end

statistical assumptions would favor additional weakness down to the 1254 area or

lower.”

Current analysis: As noted in past outlooks, taking out the 1289.00 figure favored

a test of the 1277.00 number, and taking that figure out to the downside then confirmed

the downward phase of the 34-day cycle to be back in force – which favored a drop

on down to the 1254 figure or lower. The latter was due to a normal low-end statistical

expectation in regards to the 34-day wave, when forming the pattern of a ‘lower-high’.

Noted in the prior outlook, there is the potential for a drop back to the 1230 area

before this wave bottoms, though any flip above the 1262.50 figure first, if seen,

would probably negate that assumption.

With the above, there is at least a decent shot that whatever low that is seen with

the 10 and 34-day cycles will end up as the low for the larger 72-day component.

Having said that, I can’t say this with any firm degree of certainty right now, simply

due to the weekly cycle’s forecast path (chart, above) – as well as various technical

factors, such as momentum. Even said, the one thing that the larger 154-day wave

tells us to expect is for any new upward phase with the 72-day component to end up

as a countertrend affair; in other words, the metal should remain below the 1392.80

figure. If correct, then we will see a full re-test or break below the December,

2013 bottom (1181.30) into what looks to be the month of August, plus or minus –

which would then set up the metal up for its next major low.

Copyright 2014, The Gold-Wave Trader & Forecast

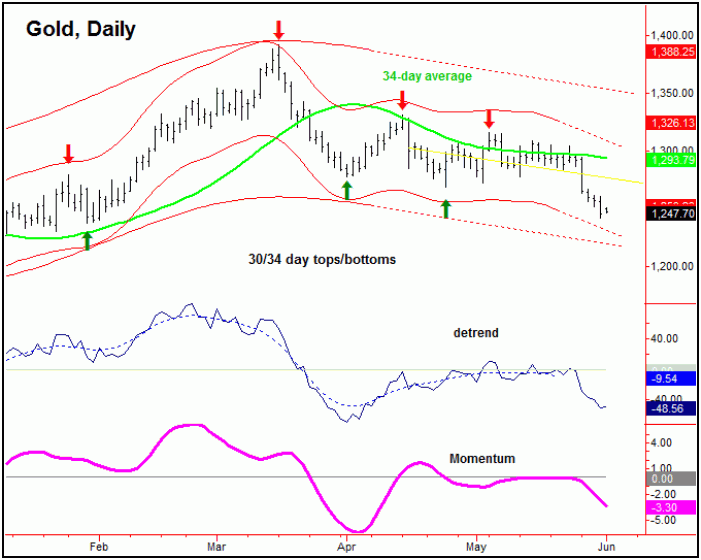

In looking at our daily/weekly forecast model (chart, above), as noted in the prior

outlook the low for the daily forecast had been adjusted slightly, with the model

looking for a short-term bottom around the 6/2/14 date, which is Monday of this week

and is plus or minus a day or so in either direction. Thus, the continued weakness

seen into Friday looks to be in line with the next bottom for the daily path – which

should also end up as the bottom for the 10 and 34-day time cycles. Having said that,

whether that low was made on Friday is too early to speculate, and with that I won’t

rule out lower numbers into the 1230’s into Monday.

With all of the above said and noted, the short-term path favors a bottom and at

least a sharp bounce into what is looking to be June 10-11, plus or minus. Any reversal

above the 1262.50 figure on Monday, if seen, would likely confirm that move up to

be in force, while remaining below the same allows for a continued break down to

the 1230’s.

Stepping back, we have the weekly cycle pointing lower from the week of 5/23/14 into

what is looking to be late-June. As for the larger-degree 72 and 154-day cycles (chart,

below, I see both as pointing south at the present time, with both having topped

at the mid-March peak of 1392.80. Having said that, the smaller 72-day component

is now around 103 trading days along – and thus is due for a bottom. Originally,

I had thought that the mid-April low would end up as the low for this wave, though

the break below the 1268 area negated this assessment – and tells us that this wave

is still heading south.