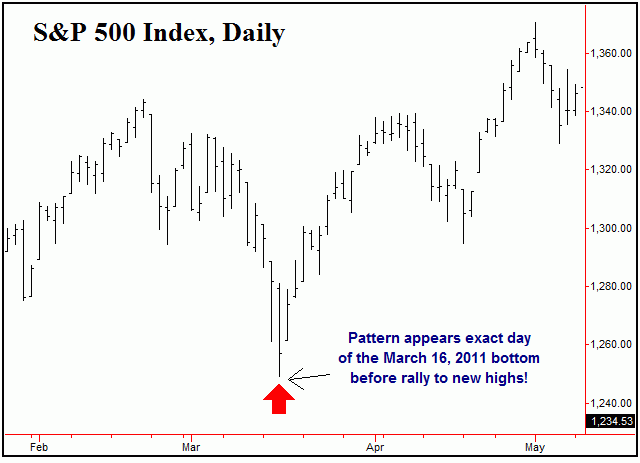

500 Cash index had formed a March bottom -

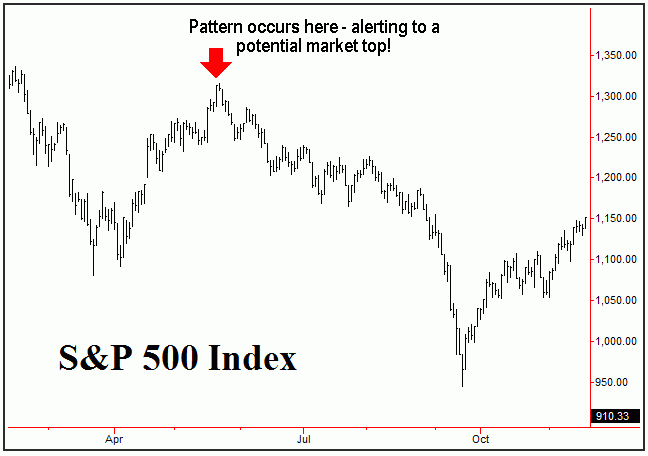

Then, on May 21, 2001 a specific pattern occurred that signaled an alert to mid-

arrow on the chart above.

spotting mid-

From this chart, once this particular pattern that I am describing occurred, you

can see that that the SPX was only one trading day away -

Now, fast-

March 16, 2011 bottom -

for the year in the following months:

I should add that that the March 16, 2011 low was not the only time that the pattern

appeared on the SPX. One most recent occurrences was seen just prior to the October

4, 2011 bottom. In fact, the actual buy signal that I outline came the very day of

that bottom -

Note that the above is documented in my public advisory service, and was a real-

More recently, the pattern appeared again in May of 2012, signaling a semi-

probably closing in on the SPX -

This pattern/setup described above does not appear often -

However, when it does appear, it normally signals an important top or bottom forming.

In fact, nearly all of the major tops and bottoms of the last several decade have

seen some occurance of this pattern beforehand. This was a setup that I first discovered

back in the 1990’s -

show up with regularity to this day!

I have completed a 29-

up, precisely what to look for -

describes the exact technical requirements for setting up both buy and sell signals;

these technical signs are extremely important for the entries and exits, and -

e-

The ‘Volatility Reversal Method’ is on sale for a limited-

for only $15 (regularly $20), and can be purchased via pay-

below (the book is in PDF format).

After purchase, the e-